Yes!

Well…maybe.

It’s complicated.

What comes into question is, why are you getting a rental car in the first place?

The Trip

I have a trip planned this week to visit the beautiful state that is Arizona. Now, my wife and I have become avid users of Uber but when we started looking into it we realized (had forgotten) how much more economic it is to simply get a rental.

So we started looking into it and found a good deal. Then the question came up, is the rental car covered? Or, do I need to use the insurance Alamo was offering?

First off a little voice in my head (out of several, jk) said to look at my credit cards. But I’m at work and didn’t want to spend too much time looking at all my card agreement so I pulled the first one out.

The Card (and it’s benefit)

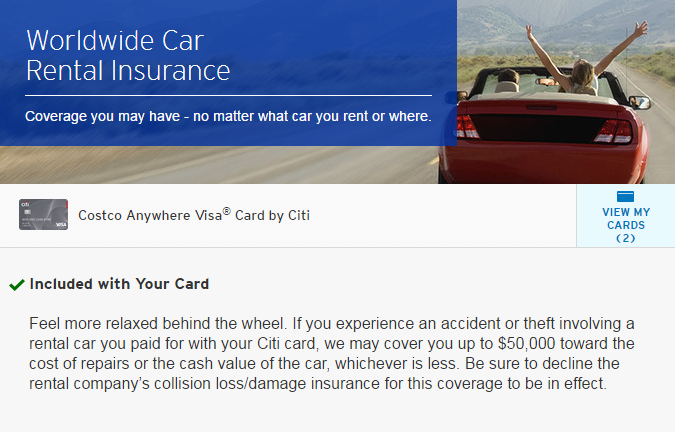

My Costco Citi card.

Upon seeing my cards benefits I stumbled on the Worldwide Car Rental Insurance.

Here’re the deets:

One thing I noted right away was the last sentence, “Be sure to decline the rental company’s collision loss/damage insurance for this coverage to be in effect”.

You mean don’t shell out for the unnecessary coverage they’re trying to force on me? Got it. Let’s move along.

Next we review the key points that interested me and my trip plans.

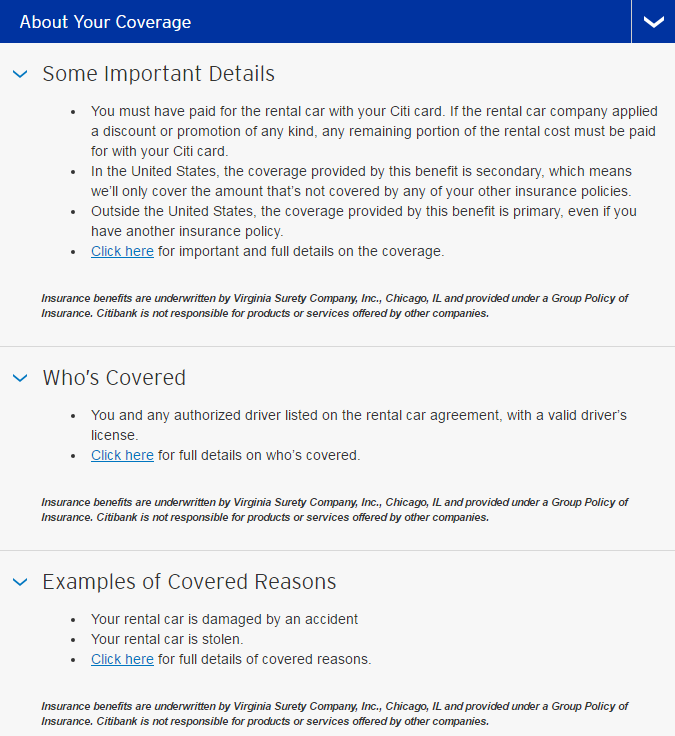

- Pay the rental with this card. No problem.

- Me and my wife are both covered. Cool.

- THE CAR is covered. CAPS is necessary here because the card’s benefit ONLY covers the CAR. Not me personally. Not my wife. Nobody. (point #2 is a lie)

This is obviously very important. Here Citibank is telling Alamo, ”Don’t worry. We’ve got your back. Your car is in good hands….unlike the two meatbags inside of it.”

(-_-)

But that’s ok. Citibank is very clear in their agreement stating:

This coverage is not all-inclusive, which means it does not cover such things as personal injury, personal liability, or third-party personal property. It does not cover for any damages to other cars or property. It does not cover for any injury to any party.

-Costco Card Benefit Guide

No surprise there. You see, in the U.S., a card’s benefit, or at least THIS card’s benefit, only applies as a SECONDARY coverage. Therefore there must first be a PRIMARY coverage. This secondary coverage will only come into effect after the primary does it’s part.

*cue in Mapfre*

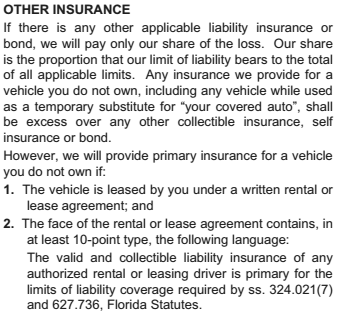

Alismary here at the office hooked me up with a nice Mapfre auto policy. So I pulled that up and read this:

Here’s the part from Florida Statute 627.736

BOOM! Now we’re talking. My personal auto insurance coverage will transfer over to my rental car.

My Coverage

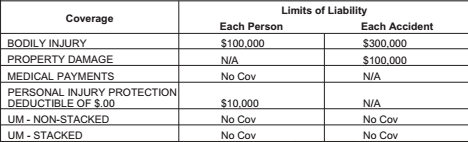

How does this translate? Let’s check out my policy:

Seems like I’m doing my part in covering the medical expenses of anyone that I might hit and I’ve also got their personal property covered. You’re welcome unfortunate person I collide with.

Now not to sound selfish but again, what about me? What about my wife?

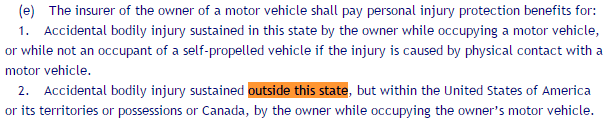

Here’s where it gets tricky. Florida is considered a No-Fault state while Arizona is an At-Fault state.

To not get into the nitty gritty it basically means that for us here in the Sunshine State we need to have our medical expenses covered by our own insurance first. Here it’s mandatory to have PIP (Personal Injury Protection) and it’s recommended to have Uninsured/Underinsured Motorist (I don’t have it) but not in Arizona.

In Arizona, and most At-Fault states, they are required to have Bodily Injury and Property Damage. It’s more of a you-scratch-my-back-I-scratch-yours system. Personally I think that’s better but that’s for another time.

So how will my No-Fault policy translate in an At-Fault state? It doesn’t. It maintains its form and simply adapts to the state I’m in.

Again. Arizona.

In case you weren’t paying attention.

tl;dr:

- My personal auto insurance only covers the liability* part of the policy in regards to the rental (*damage done to them and their property)

- Costco Citi card covers the physical damage to my rental.

- With PIP plus Arizona’s mandatory Bodily Injury protect my wife and I physically.

And with that I’m off to Arizona.

This is where I’m going by the way…

The Picture (unnecessary heading)

Maybe I’ll post something on Instagram when I get back.

Disclaimer: This is in no way endorsed or paid for by Citibank. Nor am I endorsing their cards. This was just an example of what most major cards offer nowadays and how to maximize coverage you may already have between credit cards and your auto insurance.