Intro

You said it last year…..and the year before that. “Next year I’m going to pay off my debts and start saving.”

But really what happens? It’s March, the holiday season dug you deeper, you’re still trying to pay that off, and you’re nowhere near paying off the debts you started with. Never mind growing a savings account.

I Got You

I live my life pretty frugally. My car’s been paid off for the last ten years, our rent’s low and bring lunch from home regularly (this is huge).

Although, this ensures our saving account grows. That doesn’t mean Marissa and I don’t enjoy ourselves. We go to wine tastings, two to three vacations a year (much to Luis’ dismay), and go out at least two weekends a month.

What makes this even more interesting was our debt when we got married. It was over $35,000 when you added up her new car, my student loans, and credit cards. Three years later, where is our debt? It’s decreased significantly to $9,000. And we’re both part-timers.

HOW?!

There’s so much you can do to trim the fat out of unnecessary expenses and that is a whole book in and of itself.

But today, I want to share with you two apps and two services I’m a big fan of. In love with is more like it.

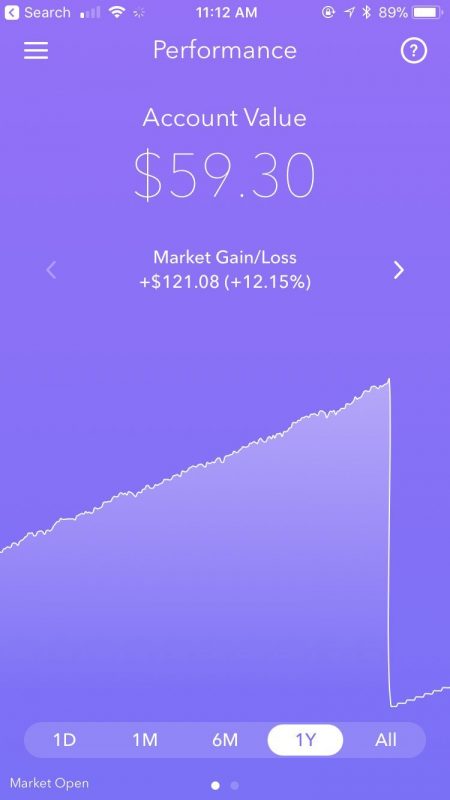

Acorns

Acorns is a nifty app if you’re completely new to the world of stocks. I started using it about two years ago investing $5 a week every Friday. I was uncertain of the app and the portfolio they’d put me in. I saw some highs and lows, as is normal with the stock market, but overall they instilled a lot of confidence.

The experts running your portfolio will re-distribute your funds if they foresee a loss approaching. So this year I upped it to $10 a week and had a great year.

A 12% return is higher than any savings account any major bank is offering. And let me tell you something about return-of-premium accounts. Return of premium is just…

Is $100 today worth the same if you went back 10 years? 20 years? No. Inflation makes your $100 worth about $65.97 in 1997. So why would you lock in a set amount of any premium in an account that doesn’t accrue any interest at all to pull it out in 20 or 30 years?

So if $50 of your month’s premium is being set aside for 20 years and we use the past 20 years as a reference, then your $18,000 will be worth $11,824.45 with an inflation rate of 2.12%. Don’t do it. There are much smarter ways to invest your money and make it work for you. Check out this calculator to play with your own numbers.

On the other hand, I invested $1,000 this year in Acorns by adding a little extra here and there and got a return of $120. BAM! Can’t beat that by basically not moving a finger.

You’ve got this. It’s only $10 a week. That’s one lunch or two Starbucks mornings. You’ll survive.

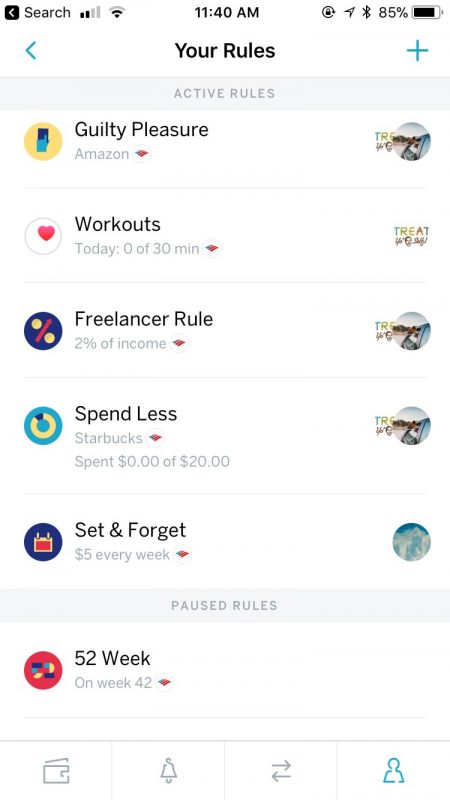

Qapital

Qapital is a beautiful app. It makes saving money so effortless and it feels so good to log in and see the numbers go up. The setup is simple.

It’s a system based on Rules. If you’re an Amazon-holic and you just NEED to see those boxes come every other day then you set up the Guilty Pleasure rule. Every time you shop at Amazon it will pull $10 from your Checking account for giving in.

If you work-out then it’ll pull $5 and set it aside as a “good for you” sorta thing. Every time you get a paycheck it pulls a percentage out. The 52 week is a powerful one. You start with depositing $1 the first week, $2 the second, $3 the third and so on until you go through 52 weeks. That means near the end of it you’re depositing over $200! It’s very aggressive but oh so nice.

Now this one doesn’t accrue interest like Acorns but I also don’t use it for such long-term goals. It’s for when we’re planning a vacation or want to set something aside for rainy days.

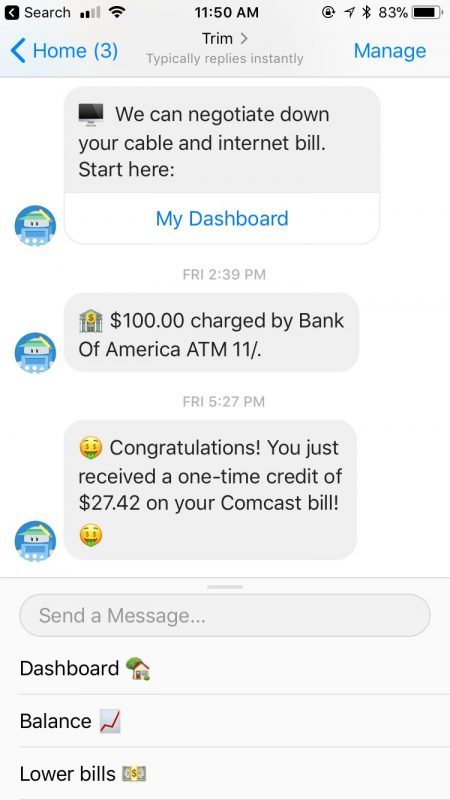

Trim

OMG TRIM! Trim is my latest proud discovery. Did you pay your cable bill last month? In September I didn’t. Trim monitors your Comcast account for outages. Because of the Comcast outages in the area, Trim sent correspondence on my behalf to Comcast and basically said,

“Hey, Comcast! Yeah, you! You’re supposed to be on 24/7 and right now it’s looking more like 18/5 so you owe us! Give Guillermo back his money or else…”

Or at least that’s how I imagine they do it. So Comcast sent me back credits. When Irma hit and we had no internet for a while (I didn’t care, I was in Alaska) Trim got me back a full month’s credit.

The best part is that sometimes the outages occur late at night when I’m sleeping. So I wake up to a message like…

It connects to your Facebook profile but it’s well worth it.

The catch? They take 20% of the credit you received but 80% of 100 is better than 100% of nothing.

At the time of this writing Trim only works with Comcast and is working to expand to U-Verse.

Earny

Earny is my least used app and that’s just cause I haven’t taken the time to set it up. I referred my friend to it and he absolutely loves it!

It’s like Trim where they are constantly monitoring your accounts subscribed to them. In this case, it’s Amazon. Now I already confessed I love Amazon so how better to alleviate that obsession than by finding an app that will get your money back.

Nowadays a lot of credit cards have a “price rewind” feature built-in where if you find a price cheaper elsewhere the credit card company will pay you the difference. The downside of this is that you’d have to be on top of your bank statements and keep cross-referencing your purchases with what’s in the stores.

Earny does this for you. For the same price as Trim (20%) they will monitor your Amazon and if an item you bought, with a credit card that qualifies, goes down in price, they will get you the difference.

The Rub

Now, these are just a few ways to make your dollar go further but in a way, these are either very short to medium-long term goals.

If you’re looking for a more stable, long-term option than keep in mind our partners. We have Charles on our team for robust life policies and smart long-term options.

Also, from our networking group, we can direct you to Stanley Parker of Ameriprise Financial for a serious stock market game or Fernando Orrego to get your estate in order.